THE RACE TO REWIRE CROSS-BORDER PAYMENTS

Money needs to keep moving—and the blockchain could be the way to achieve it

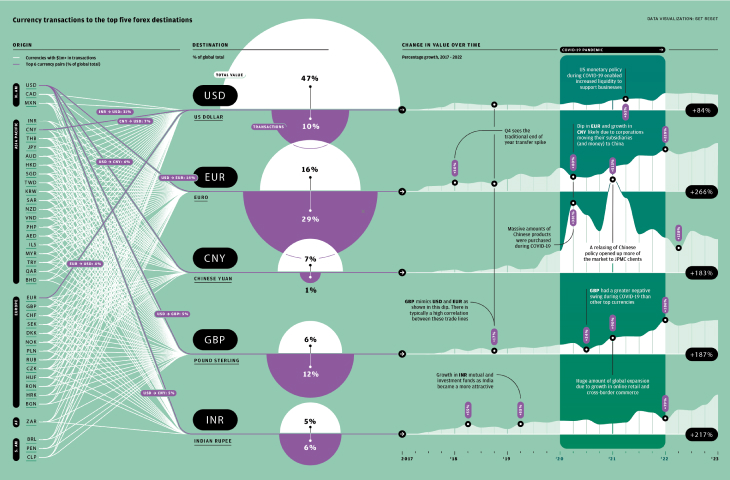

The world may be entering a period of de-globalization, but cross-border payments are on the rise. International transfers are expected to increase five percent per year until 2027. In part, this is being driven by previously unbanked populations that are now getting access to modern financial tools for the first time. But also, as established trade corridors get disrupted and supply chains become more fragmented, organizations are having to send payments to new countries—sometimes multiple new countries—as they replace established partners.

But whereas instant payments are fast becoming the norm domestically, the picture is different when businesses try to move money across borders. This is perhaps understandable when you consider that there are 195 countries all with their own payments systems, regulations, and levels of technological maturity. But it’s also an opportunity. International payments are the engine of the global economy, and reducing friction could facilitate trade and help drive prosperity.

New technologies are helping seize that opportunity, whether it’s the latest generation of real-time payment rails or more emergent ideas such as blockchain. To understand their significance, it’s important to understand how the system works now.

GLOBAL PAYMENTS 101

If a bank has a direct relationship with a bank in another country—meaning they hold accounts with each other—then transferring the money between the two is relatively simple. Bank A simply sends Bank B a “payment message”—a computer instruction detailing what needs to happen—and Bank B credits or debits the relevant account. If there is no direct relationship then typically Bank A will partner with a “correspondent” bank that has a direct relationship with both banks. However, depending on the currencies or countries involved, a single partner may not always be possible. If this is the case, then Bank A will link with one correspondent bank, which will then link to another that can fulfill the transaction with Bank B. These chains of intermediaries were the reason why historically, cross-border payments took longer than expected.

This is now changing as banks around the world have improved communications technology and expanded their webs of relationships to speed up the process. “Globally, 84 percent of payments are now either direct payments or they have one intermediary,” explains Thierry Chilosi, Chief Strategy Officer at Swift, an international cooperative of banks and financial institutions that provides the most widely used interbank payments messaging service. What’s more, these transactions are often fast, at least when it comes to back-end processing. “89 percent of the payments that flow through the Swift network arrive at the destination bank within an hour,” says Chilosi. “Half make it all the way to the beneficiary account in less than five minutes; about 80 percent take six hours, with virtually all the rest coming within the 24-hour time frame.”

But some financial institutions are also exploring new approaches that could lead to instant cross-border payments of any size, anywhere in the world.

THE RACE TO REAL-TIME

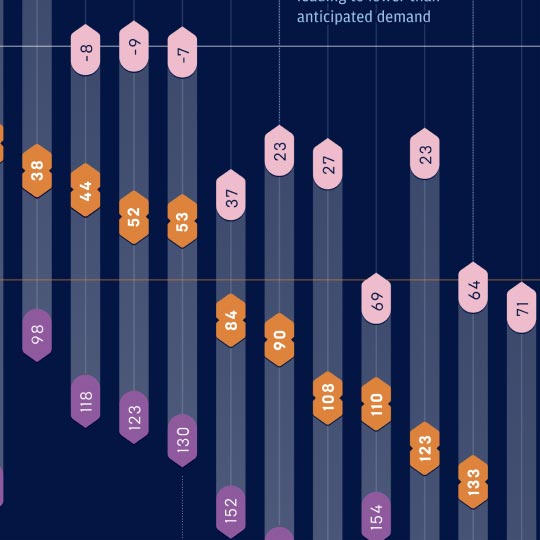

Many countries already have real-time payments (RTP) systems, where the main local banks are directly connected to an automated settlement system managed by the country’s central bank. These allow domestic payments to be processed around the clock and completed instantly. By increasing market efficiencies, RTPs are expected to generate $173 billion in additional economic output by 2026, according to the Center for Economic and Business Research (CEBR).

The impact would be greater still if real-time cross-border payments were available as well. But to do this, different countries would have to link their RTP systems together. This requires technical and legal integration between the central banks of the participating countries, as well as individual banks and banking associations. Technical processes and data formats would all have to be standardized. A single regulatory and compliance regime would have to be agreed for all the participants.

Due to the complexity, linking systems up is usually only possible when parties are close trading partners with good relations and large bi-lateral payments flows. One example is Singapore, which has recently integrated its real-time PayNow network with faster payment networks in India, Thailand and Malaysia, although this is only for smaller payment amounts, such as workers sending remittances home.

says Pawel Szejko, CFO of XTB, an online brokerage that has to frequently move money to client accounts across the globe. “Each country is different and has its own interests. As an online broker we have a lot of clients globally. For US dollars, the payments take a few days and it costs a lot; the charges are taken by corresponding banks. Often our clients are surprised by the fees.”

In the coming years there will likely be further attempts to sync national or regional payments systems together, but this won’t be quick: A single bi-lateral link can take years to establish. “Ultimately, where we want to get to, is the ability to instantly settle any payment in any currency, anywhere, any-time,” says Jason Clinton, Head of Financial Institution Group Sales Europe at J.P. Morgan. “And that will probably require using blockchain technology.”

Blockchain could allow banks to leapfrog existing payments infrastructure

IS THE FUTURE ‘ON-CHAIN’?

Blockchain technology has the potential to help financial institutions to leapfrog to an infrastructure that is able to support near-instantaneous transactions and automate complexity. Blockchain was initially created to enable cryptocurrencies to operate without the need for centralized clearing and settlement of transfers between two parties. In the traditional system, banks keep their own separate records (ledgers) of all their transactions. When a payment is made, the ledgers of the two parties have to be reconciled. With cryptocurrencies, there is a single digital ledger, the blockchain. Every time a transaction is made, it is checked against this shared ledger to make sure the participant has the required funds to complete the transaction. What makes blockchain unique is that it is “distributed”: many computers hold copies of this ledger, and if a transaction is validated then all copies are updated. That means if one ledger is tampered with, perhaps to fraudulently boost an account, it won’t be consistent with the rest of the network and the activity will be voided. With a single, shared source of truth, transactions can be securely settled and verified in minutes, without the need of a central arbiter overseeing proceedings. Unlike public or “permissionless” blockchains, which are typically open to anyone, a number of financial institutions are using private, or “permissioned” blockchains, in which participation is controlled. A crucial benefit of a private blockchain is that it enables institutions to retain sovereignty over it, meaning they maintain control over the system and define how data is shared.

Some believe that private, permissioned blockchains are well-suited to conducting cross-border transactions. They offer a crucial quality that has yet to be unlocked across existing international payments systems: They are always on.

“With the advancement of digital payment systems, there is an increasing need for an infrastructure that enables institutions and their clients to send and receive payments 24/7 across borders without being limited by cutoff times including across weekends and holidays,” Naveen Mallela, from J.P. Morgan’s Onyx blockchain division says. “By leveraging blockchain technology, we are able to enable a more dynamic way to manage treasury operations, especially during times when liquidity is constrained.”

Blockchain-based networks could also offer a range of other benefits, such as faster settlement, and being more readily accessible to those who wish to participate. In addition to the obvious security advantages, which would help tackle fraud, they may also be more reliable as they have no single point of failure.

What’s more, through blockchain’s “smart contracts”— on-chain programs that execute when certain conditions are met—blockchain can automatically trigger payments based on real-time data inputs, paving the way to automating complex transactions and reducing the need for manual operations.

Pham Thi Ngoc Anh, EVP, Head of Financial Institutions Group at the Bank for Investment and Development of Vietnam agrees: “When compared with traditional banking systems, blockchain technology can provide greater reliability and much lower costs for international payments.”

Another added advantage of blockchain-based infrastructure is the ability to settle different forms of currency, including Central Bank Digital Currencies (CBDCs). CBDCs are digital forms of a country’s fiat currency, backed by a country’s central reserve. The J.P. Morgan Onyx blockchain division has conducted a successful simulation to test the technical feasibility of cross-border transactions in Singapore dollar and euro CBDCs using a permissioned blockchain network in conjunction with the Monetary Authority of Singapore and Banque de France.

“Around 90 percent of central banks globally are currently working on developing a Central Bank Digital Currency,” says Clinton. “But ultimately, in the short-term, blockchain will not replace existing payments systems—it will complement them.” This is because blockchain faces a number of barriers to ubiquity in cross-border payments. These include regulatory uncertainty, as well as a lack of technical interoperability between blockchain networks. Different groups may develop projects, but there is no guarantee they will work together. Cooperation and collaboration at scale would remain a necessity. Unless one blockchain network becomes the global standard, the existing problem of siloed payments systems could simply be replicated.

Blockchain could be used to pre-validate payments for better success rates

BLOCKCHAIN DATA NETWORKS

In coming years, then, blockchain may initially be used to improve rather than supplant existing processes. One possible use case is pre-validating payment information. According to data analytics company LexisNexis, up to 50 percent of payments that don’t complete or are delayed are due to simple data entry problems such as incorrectly typing the bank name and address, or getting the account numbers, IBAN or Swift BIC codes wrong.

Pre-validating the beneficiary’s bank account information before the transaction is sent would reduce the risk of failed payments and fraud. But doing this internationally is challenging thanks to the privacy and security concerns around sharing data across borders. “Collaboration amongst financial industry participants is necessary to unlock the power of collective intelligence,” says Onyx’s Sushil Raja, Global Head of Liink by J.P. Morgan, a peer-to-peer data sharing network.

Institutions would be more likely to collaborate on that kind of information sharing if those privacy and security concerns could be allayed. Some believe that a private, permissioned blockchain network could be the answer. That’s because blockchains aren’t limited to financial transactions, they can also enable data transactions. The immutable nature of blockchain means that information can’t be altered by bad actors, and it also acts as a permanent record of what has happened: Users will know where information has gone and who has accessed it. These inherent security advantages could deliver the required level of confidence to achieve mass collaboration.

BACK TO FRONT-END

However the cross-border payments system evolves, it will take time. Industry figures note that making the current system as easy as possible to work with has to be a priority. And that comes down to something which is arguably as valuable as speed and cost efficiency: Customer service.

If an international payment doesn’t arrive or is delayed, a company wants an easy way to have the problem resolved. As Frances Cavanagh, Treasury Global Process Owner for global insurance services provider WTW puts it: “A lot of time is spent chasing transactions that somebody is claiming they’ve not received from the bank. While some of our partners give you the ability to track these transactions through online bank portals, it’s a very manual process.”

Rian Kaslan, Senior Executive Vice President in Digital Business at Bank Negara Indonesia (BNI) shares those

frustrations. “Gone are the days where businesses want to call someone. If they don’t get instant

updates and notifications, it’s already considered a lack of service.”

Solving this issue is certainly achievable. BNI, for example, has developed a customer portal for business

customers, BNI Direct, which provides clients with payment statuses and notifications, for both domestic and

international transactions. It also provides information on the documents and information each specific country

might need to process payments and transactions.

As international payments continue to transform, it will be important to stay mindful of a Silicon Valley maxim: Start with the customer experience and work back towards the technology.

BY J.P. MORGAN

SOURCES AS PER WIRED, AUGUST 2023

ILLUSTRATION: ULA ŠVEIKAUSKAITĖ