Even as treasury teams evolve to take on more strategic roles, their core responsibility remains the same: to know how much money a business has, where it’s held and how to maximize use of funds so the business gets the most out of its money.

To gain insights into liquidity, treasury needs a well-defined approach to cash positioning and cash forecasting. These processes—which are distinct but closely related—are essential to daily financial operations and decision-making for companies of all sizes and structural complexities.

At a high level, cash positioning and forecasting can help businesses maximize investments, minimize expenses, map out expansion plans and much more.

What is cash positioning?

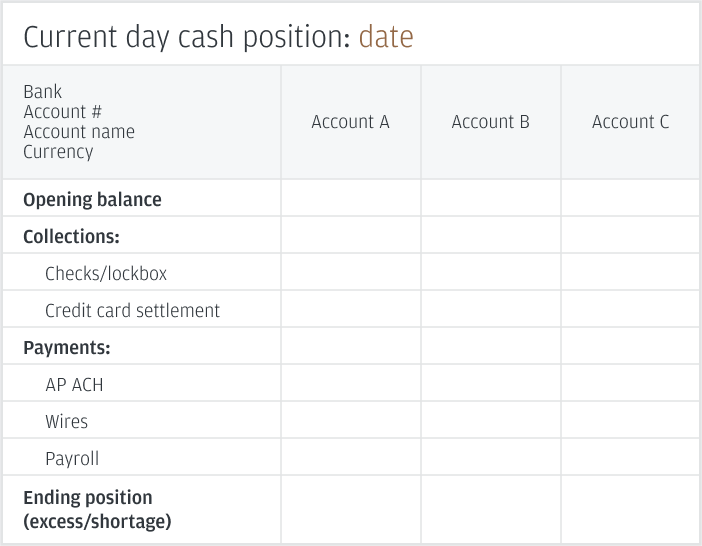

Cash positioning is the practice of aggregating daily account balance and transaction information in a single place to ensure there are enough funds to cover daily operating needs. That may be an Excel spreadsheet or treasury management technology that includes tools for cash flow planning.

Why is it important? The value of cash positioning can be expressed on two levels:

- It helps to ensure the business has visibility across organizational cash levels and the funds to meet obligations.

- It provides a snapshot of liquidity that’s easy to digest and access, helping business leaders make informed decisions that get the most out of their funds.

What does the process entail? Many businesses use Excel for cash positioning, even billion-dollar companies. That means every business—regardless of its size—has the ability to conduct daily cash positioning.

To start, here are some things to consider:

-

Identify all accounts, including those used for payroll, domestic and international operations, or by specific business segments. Prominently showing key accounts with the most activity is best practice.

-

Create a worksheet or template that reflects how your business manages your cash and funding. Determine the right level of detail necessary to create the position without making it an onerous process.

-

Aggregate critical data such as opening and available balances, expected inflows/collections and expected outflows/payments, potentially categorized by transaction type.

-

Leverage technology solutions to automate the data pulls from both your bank and your internal systems.

What are some of the key benefits of cash positioning?

The resulting current visibility into liquidity helps allow companies to:

- Make more informed decisions: Cash positioning eliminates guesswork. Business leaders can reference current data to know exactly what they’re working with, which leads to more efficient and informed decisions on their use of available cash.

- Reduce extraneous costs: Even if businesses have money in a broad sense, if it’s not in the right account, there could be operational disruptions. Cash positioning can help mitigate the potential for overdraft fees, unnecessary borrowing or extra wires.

- Improve risk management: Knowing where your cash is held allows you to better manage your counterparty risk and ensure that as much of your cash as possible is held with trusted financial institutions, while also allowing you to adjust those exposures as necessary.

Refining cash positioning processes

Excel can be sufficient for cash positioning in some situations, but it can also be time-consuming. As your business grows or adds complexity or more accounts, you may want to explore ways to automate cash positioning and mitigate risk, save time and free up personnel to do more valuable tasks than manual data entry. Options may include:

- Bank-provided Excel API plugin: Some banks offer an API that automatically pulls daily balances and transactions for easy input. Tools like Access Insight from J.P. Morgan Access can save treasury teams time when aggregating data.

- Cash positioning software: Several enterprise resource platform (ERP) solutions and treasury management systems (TMS) come equipped with cash positioning tools. They can be used with Excel, or as a substitute.

- Multibank reporting: Cash positioning software may also offer multibank reporting, which consolidates data across banks and delivers it through a single portal—something Access can do. This service can save additional time in the positioning process.

What is cash forecasting?

It’s a way to estimate future cash levels over a specific and longer period of time using anticipated inflows and outflows.

These forecasts can be used for short- or mid-term planning, and assist with treasury objectives like debt management, funding, cash repatriation, investment and enablement of business growth.

There are two general approaches to cash forecasting:

- Bottom up starts with granular data (commonly gained from daily cash positioning) and extrapolates that into future performance. This generally requires relationships with other business units (e.g., human resources, legal and finance) to supply information.

- Top down leverages historical data and broader assumptions to work down to projected cash levels. Treasury teams can use cash flow statements, previous budgets and receipts to inform the forecast.

What are the benefits of cash forecasting?

Forward-looking cash flow projections can help companies accomplish a number of goals, including:

-

Short-term and mid-term strategic planning: Planning on new market expansion? A new product line? Share buybacks? Cash forecasting can provide the liquidity baseline needed to carefully plan for these efforts.

-

Optimized cash usage: Cash forecasting can help companies more accurately determine whether they have sufficient cash available. With this information, treasury can more efficiently deploy or pool funds so that cash is not sitting unused or trapped in complex structures.

-

Foreign exchange insights: Cash flow forecasts help companies examine their short-term foreign exchange exposure. This, in turn, allows them to prepare for FX volatility and mitigate "trapped cash" risks.

How we can help

Contact J.P. Morgan or your banking relationship team for more information about our treasury services and how they can help your cash positioning and forecasting efforts.

© 2022 JPMorgan Chase & Co. All rights reserved. JPMorgan Chase Bank, N.A. Member FDIC. Visit jpmorgan.com/cb-disclaimer for disclosures and disclaimers related to this content.