Introduction

Small businesses and consumers stand to gain much from the latest innovations in cross-border payments, which are making even low-value transactions faster, cheaper and easier.

But now Swift, the financial industry co-operative that was behind the advancements in high-value cross-border payments, is bringing those same benefits to consumers and owners of small and medium-sized businesses. Faster and easier low-value, cross-border payments are coming, and they are going to increase choice and competition because it will be easier to tell exactly how much a cross-border transaction is going to cost, says Raouf Soussi, Head of Strategy for Enterprise Payments at BBVA.

“Transparency will allow customers to compare the price, quality and deadlines of the different solutions available – a comparison that until now they could not make – and choose the one that best suits their needs. Knowing the exact costs upfront allows them to compare offers between different financial entities and increases their choice capacity.”

Breakthrough services

Low-value payments is one of the fastest growing segments in the financial industry. For the global economy, advances in low-value transactions will be a major facilitator of easier trade in goods and services. A significant recent breakthrough has been Swift Go, a service that launched in 2021 and enables banks to cater to small businesses and individuals making and receiving cross-border payments.

Swift Go offers the speed, transparency and clarity on fees that the world has been looking for in smaller transactions, says Rosemary Stone, Swift’s Chief Business Development Officer. “It introduces certainty for the payer and the recipient. Whether it’s a freelancer designing websites for companies around the world, or an expatriate sending money back home to support their family, fees and FX applied are guaranteed. And the payment will be delivered at speed.”

To date, more than 85 per cent of Swift Go payments have been credited within three minutes and, so far, more than 500 banks, with a presence across 120 countries, have signed up.1 As the network grows, convenience and service for customers globally will improve. Innovations such as payment pre-validation – which checks that a beneficiary’s account name and number are right before a payment has been executed, utilising data from billions of transaction messages on the Swift network, will further improve transaction times and reliability.

Answering the needs of the unbanked

But what of those outside the conventional banking system? The scope to transform the ability of the unbanked to transact across borders is one of the most exciting features of new approaches to cross-border transactions, says Gayathri Vasudev, Head of Cross-Currency Payments

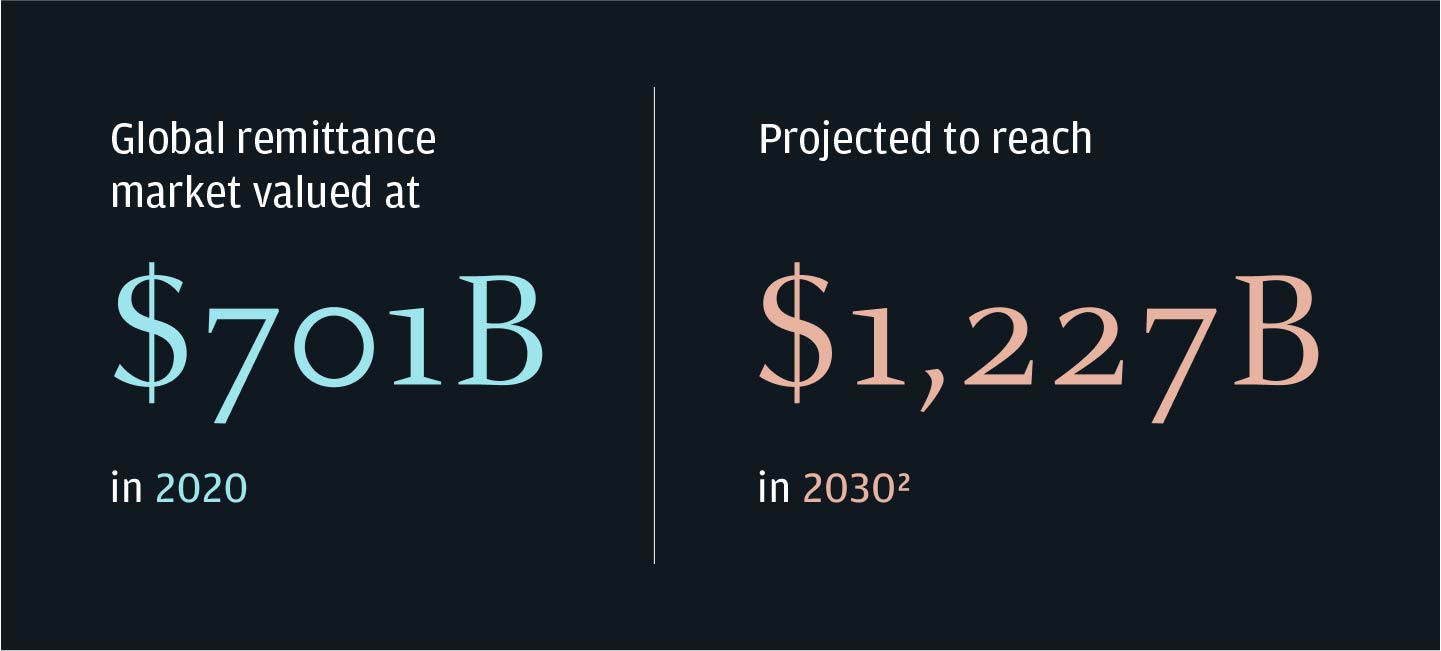

“A lot of people sending and receiving these payments are not within the formal banking system and have to adopt informal value transfer services, such as Hawala, to send cross-border remittances, further decreasing transparency of such payments.” This large and growing global remittance market, valued at $701bn in 2020, is projected to reach $1,227bn by 2030.2

“The options to make small remittances will rapidly transform as new payment rails, fintech market entrants and increased digitisation combine to create new solutions” says Gayathri Vasudev. JP Morgan’s Xpedite Remit, which is aligned with the objectives of Swift Go, is one example of the trend towards making consumer-to-consumer remittances cheaper and faster, by settling them via local real-time rails where possible.

“The options to make small remittances will rapidly transform as new payment rails, fintech market entrants and increased digitisation combine to create new solutions.”

Gayathri Vasudev

Global Head of Cross-Currency Payments, J.P. Morgan

“Industry initiatives including Swift Go will go a long way to increasing transparency and reducing the cost and friction associated with cross-border, low-value payments,” concludes Vasudev. The proportion of the unbanked is expected to reduce. The use of electronic wallets and new initiatives such as central bank digital currencies (CBDCs), which will further increase financial inclusion and help reduce the barriers to low-value, cross-border payments.

This article is a SWIFT and J.P. Morgan feature originally posted on The Financial Times.

Stay current

Hide

Stay current

Hide

Related insights

Payments

Three megatrends disrupting the cross-border payments landscape

Oct 06, 2021

Three emerging megatrends across payments, technology and risk will disrupt the cross-border payments landscape and create new opportunities. To remain competitive, financial institutions must deliver faster, cost-effective and more secure cross-border payments to their clients. Here are the implications of these trends and the opportunities to consider.

Read more

Payments

Nov 01, 2021

The next decade of payments promises to be even more transformational than the last.

Read more